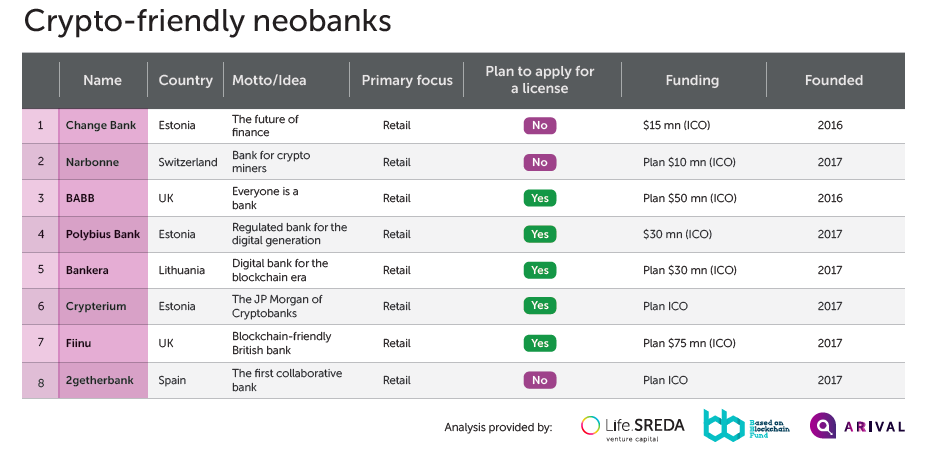

New ICO-backed crypto-friendly neobanks are going to raise about $150M this year — about half of the investment attracted in 2016 by “traditional” fintech neobanks

· The overview covers 8 crypto-friendly neobanks (2 have already held ICOs, 6 are in the process). They have already raised more than $45 million in crypto, and are going to raise about $150 million in aggregate. This is about half of the investment attracted in 2016 by “traditional” fintech neobanks, which are higher in number and at a later growth stage!

· None has gone live — at best, they have implemented a registration module for the future neobank (digital KYC). But even these solutions in the field of blockchain-based digital KYC, judging by the information available, have not been accredited by the central banks or data protection authorities. Meaning that these startups just have it.

· All are going to serve retail customers — no one is focusing on small and medium business. Whereas in the context of major problems with traditional banks and the existing (not in the future but current) needs for crypto-friendly neobanks, it is the SMEs that are now the most mature target audience: about 500 startups that have already held ICOs (raising over $3 billion which they can’t freely use), crypto-exchanges themselves, crypto-payment startups, and other community members. Moreover, these SMEs are now bringing greater number of retail customers (their employees, partners and customers) than those predicted in the future by new crypto-friendly neobanks.

· They are all being established by those who have launched startups before (in some cases fintech startups, but not Class A names), but not banking startups (lacking the experience of communicating with the regulator), neobanks\challenger banks. For example, one of the startups had successfully raised money through the ICO, but when they have applied for a license, they have discovered that the regulator was not ready to accept phiath in the bank’s capital after the conversion of the crypt raised from the ICO. Considering that almost all of them are going to apply for their own licenses, but none of them have ever done it before, the question arises: there is no doubt that they know how to make cool applications, but do they have enough experience to launch and run a regulated bank?

· One crypto-friendly bank has made a pretty strange move claiming: we accept crypto to establish a crypto-friendly bank, but “in the beginning we will not work with crypto, in order to obtain a license first.” It sounds like “we are opening a gay-friendly bar, but we won’t serve gays for the time being, and, just to be on the safe side, we will participate in gay-bashing because the society requires such behavior.” Am I wrong?

· They all reincarnate “card + app to manage your account” — exactly what has been done a long time ago by the previous and current generations of “traditional” fintech neobanks. That is, instead of taking into account their best practices and adding blockchain / crypto component — they are really reinventing the wheel. “I want to give rise to a new style of verses but I would like to start with reinvention of the English language”. If you are a blockchain expert who is well aware of the current needs of the crypto world, shouldn’t you add your knowledge and functionality (and licenses) to existing neobanks, actively building partnerships with them rather than cannibalize the immature market?

Source/More: New ICO-backed crypto-friendly neobanks are going to raise about $150M this year — about half of…