The U.S. Securities and Exchange Commission (SEC) has issued a statement on celebrities using social media networks to encourage the public to purchase Initial Coin Offerings (ICOs) and other investments, indicating that such ‘endorsements’ may be unlawful if compensation is paid and not disclosed.

With a gob of money being thrown at Initial Coin Offerings (ICOs) of late and breaking records amid the price of Bitcoin hitting new highs, the U.S. Securities & Exchange Commission (SEC) has issued a statement in relation to “celebrities and others” using social media networks to encourage the public to purchase stocks and other investments.

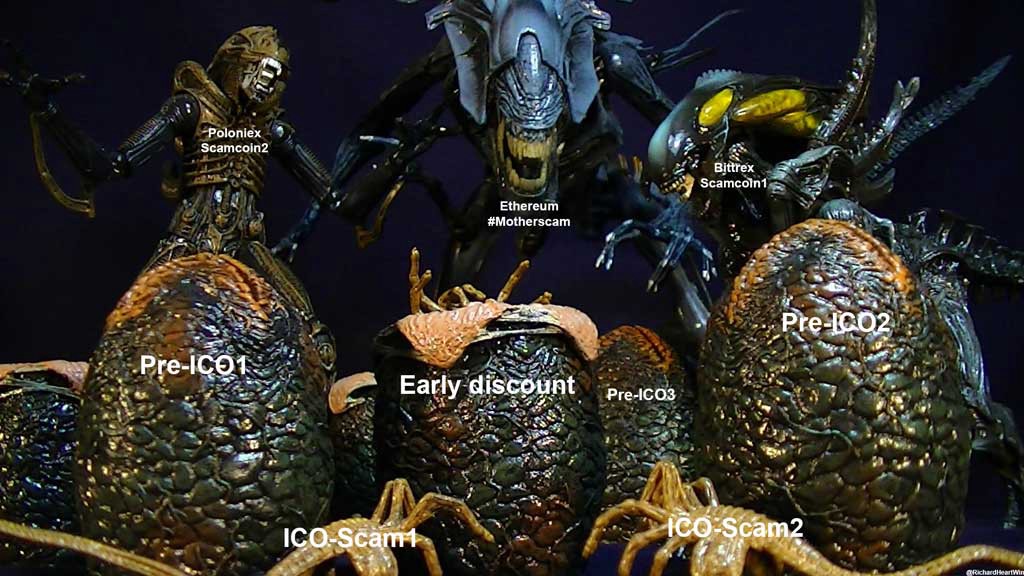

“These endorsements may be unlawful if they do not disclose the nature, source, and amount of any compensation paid, directly or indirectly, by the company in exchange for the endorsement,” a statement from the SEC issued this Wednesday read. And, indeed there is a lot of money sloshing around in the space with ICOs having raised around $2 billion so this year, with a plethora of ventures from across the industry spectrum tapping the market.

The SEC’s Enforcement Division and Office of Compliance Inspections and Examinations is encouraging investors to be “wary of investment opportunities” that sound too good to be true.

“We encourage investors to research potential investments rather than rely on paid endorsements from artists, sports figures, or other icons,” it added. The SEC noted that celebrities and others have recently promoted investments in ICOs.

Citing their Report of Investigation (July 25, 2017) concerning The DAO, a Decentralized Autonomous Organization created by Slock.it and Slock.it’s co-founders, the U.S. financial regulator warned that virtual tokens or coins sold in ICOs may be securities, and those who offer and sell securities in the United States “must comply with the federal securities laws.”

Source/More: U.S. SEC Warns Over Crypto ICO’s & ‘Potentially Unlawful’ Celebrity Promotion