The Next Revolution is already Happening

Over the past few weeks, I’ve had the pleasure of meeting the next revolutionaries in the democratization of money. This was while looking to understand better the guts of the blockchain tech and how it differed from crypto to crypto. I had the pleasure of meeting with and speaking to several people involved with Bitshares and those involved at the periphery with Arisebank. During that time, by coincidence, Arisebank was in the process of doing the deal described in the headline. And I was able to look through the glass at this event where people were ,to my eye, looking to facilitate the transition from intellectual ideas to applications in reality. That is what Capitalism is in part about. Providing a service that fills a need and makes it easier which gets you paid. Not making a dollar and being apathetic if the service actually helped someone. Free market capitalism allows for new ideas to make it (or not) on their own merits. That is what I saw. The potential for self-clearing markets to reassert themselves and for money to get to where it is needed most without incumbent toll booth operators throttling ideas fortheri own benefit.

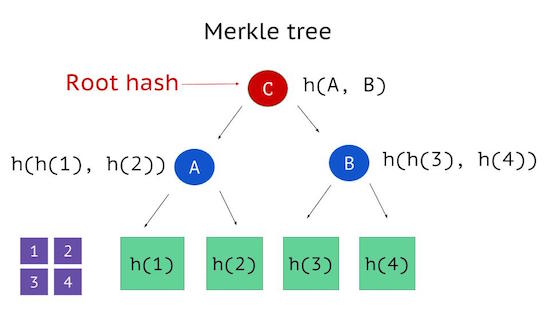

I saw people who will make a bundle of money by adding value to a system in need of overhaul. i spoke wit ha few on a guarantee of anonymity. One key person said to me in response ot me pointed question that blockchain is the beginning, Bitcoin may be the early pioneer, but like the Palm pilot, it was replaced by better tech. Why wed yourself to Blockchain?:

“Look, the tech is evolving, and we are already looking at how Quantum computing will make different types of tech more palatable than blockchain. I agree with you. In a few years at most, something better will come along. And that is a good thing. Because the goal here is to use these new tools to remove the friction in all things that prevents ideas from getting their chance to make it or not on their own merits. If you ( he was addressing me directly here) have an idea that will make a market more efficient and serve the greater good, I want to hear about it. Because now, I can help you get it into “production” much easier because of what we can do.”

My response was: Sure, I feel intermediaries in general that do not add value need to be removed. Frankly, I feel Precious metals producers’ have been victims of their own ignorance for years. As a result they are captive clients to intermediaries who tell them when to hedge in order to maintain their credit line. Meanwhile those same firms that manage the producer’s banking, LOC, ISDAs, and production hedging are making money not just from those services, but on the prop-side of being able to benefit from the natural sell order flow captive producers provide. This is too much friction from production to user. It’s like a poorly connected pipeline slows waterflow”

His response was simple:

“Exactly. And we are already working with someone who is working on solving that problem right now. You should connect with them. “

And in 24 hours I was involved in a pressure cooker with a couple geniuses having conceptual discussions on how to use the available tech to make more precious metals distribution from producer to end user more efficient. The point is, the man quoted above was all about making it happen. And it likely will if the people I’m now talking with and learning from get their wish. i hope to be sharing more on this topic soon. Moving on to the event at hand today.