Normally, the concept of wealth redistribution involves government using force to take from some people and give to others. But the bitcoin revolution is redistributing wealth differently.

For the sake of simplicity, and to avoid confusion, we will talk about only the original bitcoin in this article and avoid the likes of cryptocurrency products such as ethereum and initial coin offerings, as well as recent duplicates of the original protocol.

On the one hand, at a price of $15,500 and a market capitalization of $277 billion at the time of writing, bitcoin has made many people rich. Most of the early bitcoin adopters who made the real money are young and entrepreneurial, and they have been put at a disadvantage by the status quo of the current financial system of fiat and bank money.

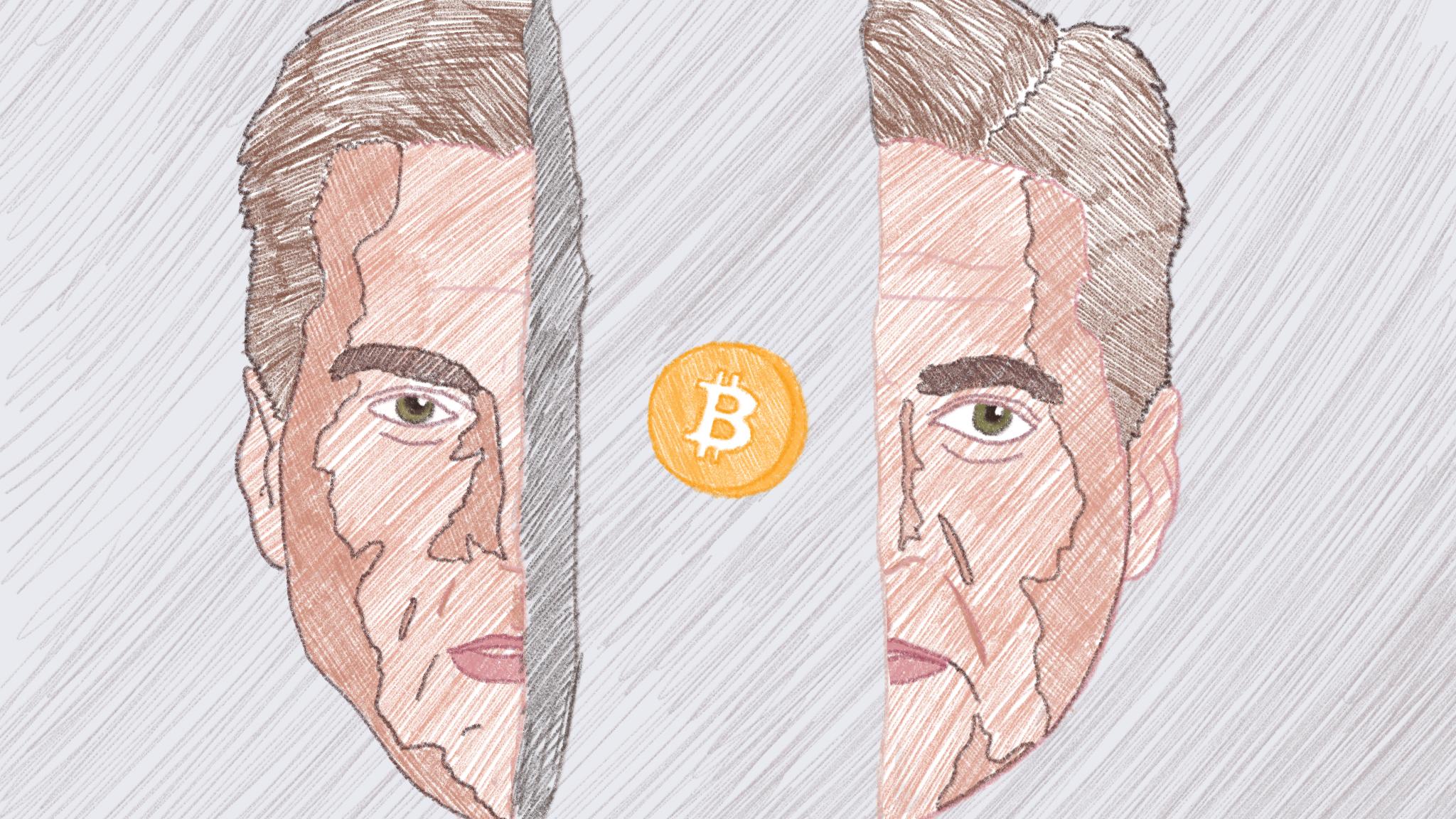

On the other hand, we have the representatives of the old money system, the Jamie Dimons and Joseph Stiglitzs of the world, who have made a fortune using the old system (Dimon) or gained prestige and recognition talking and writing about it (Stiglitz). At this moment, they are losing out. The value of their assets is getting crushed in bitcoin terms, and more people are becoming interested in the 8-year-old cryptocurrency.

The price of one share of JPMorgan stock was worth 0.084 bitcoin on Jan. 3, the first trading day of the year. On Dec. 1, it’s worth only 0.0096, a decline of 89 percent. We can calculate similar numbers for the S&P 500, the 10-year Treasury, and even bitcoin’s competitor for sound money, good old gold.

Bitcoin is often compared with penny stocks, but only the best can compete with bitcoin’s 1,500 percent price rise this year and with a valuation of $277 billion, bitcoin is pushing into the sphere of the heavyweights of finance. But that’s still a far cry from the $8 trillion valuation of global gold, the $20.5 trillion U.S. government debt market, or the $80 trillion of global stocks.

Sophisticated Wealth Redistribution

So what will happen if the price of bitcoin keeps going up, to $50,000, to $100,000, or even to $1 million, a value at which its market cap ($16.7 trillion) would be roughly equal to the combined balance sheets of the Fed, the European Central Bank, and the Bank of Japan (totaling $14.5 trillion)?

It’s not that the $15,500 you spend to buy one bitcoin now is sucked up by the bitcoin blockchain and disappears out of existence. It is transferred to the person who sold you the bitcoin, and he or she can spend it on other assets or goods and services.

If the price of bitcoin keeps going higher, the relative value of it and other assets will change, similar to the example of JPMorgan stock, which became almost 90 percent cheaper in bitcoin terms this year.

Not only will the dollars in your pocket become worth less in the process (down 92 percent in bitcoin terms this year), but also any other asset that doesn’t keep pace with the rise of bitcoin will drop. People holding bitcoin become richer not only relative to U.S. dollars, or euros, or yen, but also relative to the stock market and gold.

And all this happens without a single government rule or regulation. However, there are other mechanisms preventing people from getting into bitcoin and participating in the upside, although none of them includes the use of force.

Source/More: Is Bitcoin Just a Brilliant Wealth Redistribution Scheme? | bitcoin | The Epoch Times