On Tokenomics and ICO Valuations

There have been countless blog posts and podcasts all helping to unravel the technical breakthroughs and enigmas that make cryptographic tokens possible. As fascinating as it is to discuss the technology behind tokens, I want to go in a different direction.

What follows is a brief look at a primary way that tokens can function in decentralized organizations. As an investor, deeply understanding the function(s) a token has in its organization is the key to determining how the value of that token will appreciate in relation to the growth of that organization.

Once you understand the token well enough, you can more accurately back out its potential value by looking at the projected growth of the tokenized organization and the way that the demand for the token would scale in proportion. This is rather high level and abstract at the moment, I’ll go into a specific example shortly.

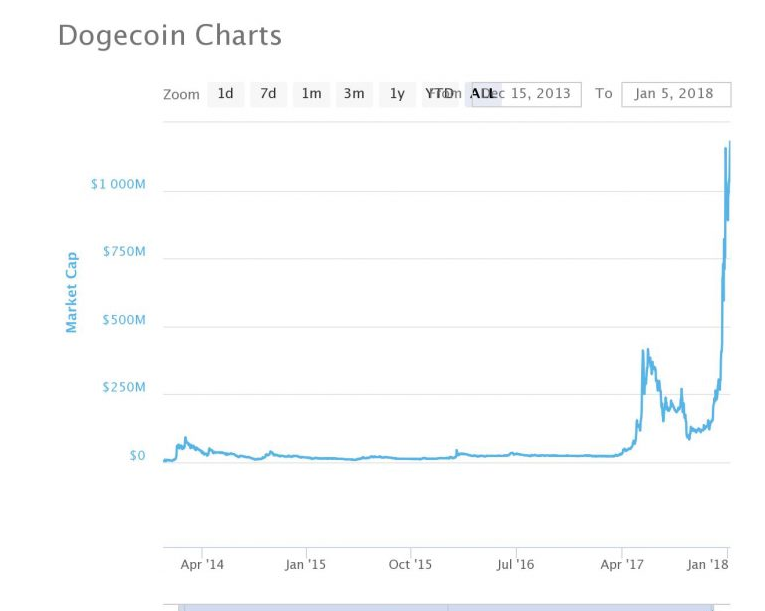

First let me point out that as a hedge fund manager who focuses primarily on ICO investing, I empathize with the view that the valuation approach described above seems a bit idealistic at the moment. Case in point, the speculative frenzy we find ourselves in is so fierce that even self-defined “joke coins” find themselves sporting billion dollar valuations.

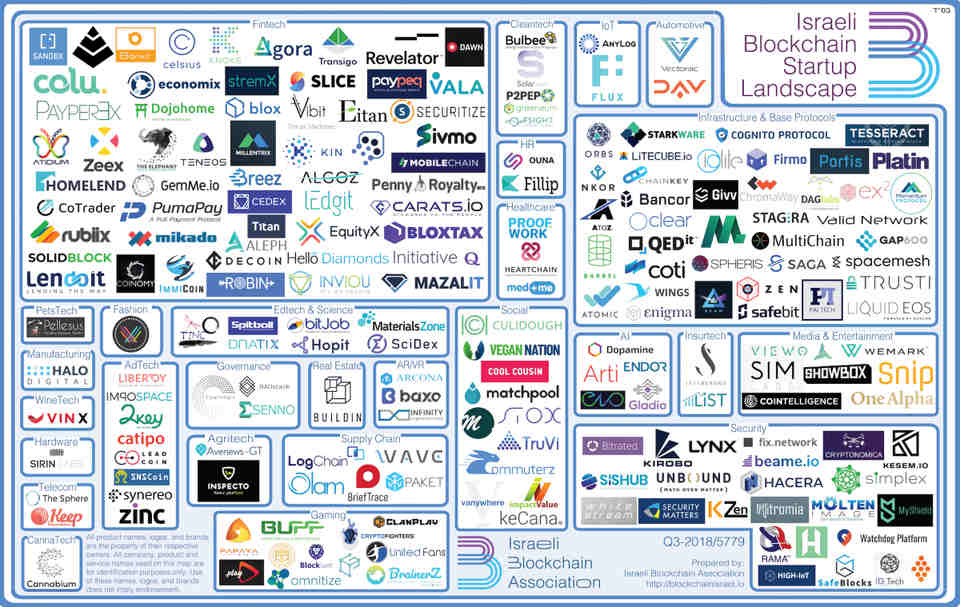

It is clear the cryptocurrency market as it stands is not known for its fundamental analysis, such as the price to earnings ratio, one finds in the equities market. However, ICO tokens are rapidly emerging as the organizational blueprint for the economy of the future. This is further evidenced by ICO fundraising significantly outpacing early stage venture capital in the second half of 2017. In any case, the bubble will end. And when it does, it is important we have molded our economic intuition to better match this new economic and organizational paradigm.

Now let’s go through a concrete example of tokenomics by first defining what a token means in the context of the organization it is attached to and not in the purely technical sense. The below definition of a token is taken from William Mougayar June 2017 article on a “business guide to tokenomics”(highly recommended reading)

Interestingly, the first half of this definition captures the essence of how tokens differ from stocks, at least in theory. If you’re interested in learning more, I covered this topic in depth in an earlier post.

A general classification of tokens that do not fall under the purview of securities or equity can be lumped into the catch all category known as “utility tokens”. Utility tokens are typically associated with applications (they are also sometimes called “app coins” because of this) and they are tied to a given application in any number of ways. Let’s take a very high profile ICO offering a utility token as a case study: Filecoin.

Source/More: On Tokenomics and ICO Valuations – Dean Patrick – Medium