Part 1 of a comparative analysis between Ethereum, Hyperledger Fabric and R3 Corda

by Brent Xu — Protocol Business Architect at ConsenSys

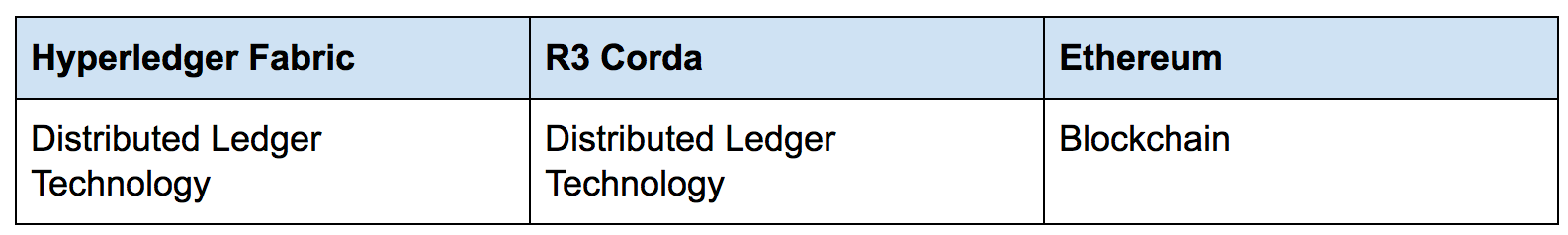

The Ethereum blockchain maintains both similarities and differences when compared to distributed ledger technologies like Hyperledger Fabric or R3 Corda. In making well founded assessments of blockchain and distributed ledger platforms and the value they bring to enterprise, it’s useful to categorize platforms based on their core functionality and characteristics. As blockchains were derived from tenets of cryptography and data configurations, certain functionality can be replicated in a coordinated database system, while other functionality is only feasible in a true blockchain environment.

In this article, we’ll assess the foundational business functionalities for the main enterprise facing platforms including Ethereum, Hyperledger Fabric and R3 Corda in terms of where the software acquires its influence and how the system is overall optimized, whether through traditional distributed systems or a contemporary blockchain basis.

In particular, we’ll focus on three key areas of functionality:

- Data coordination — How information and trust within a system is better distributed and allocated among stakeholders

- Cryptoeconomic internal incentive layers — How is a system architected so that different stakeholders and users are motivated based on economic incentives to ensure functionality of a system eg. Game Theory and mechanism design.

- Integration into the digital commoditization of assets — How the systems can integrate into a digital goods economy. In some nominal characterizations this is known as the token economy

Main goals of blockchain: what do businesses want to achieve with this technology?

Blockchains such as Ethereum have similar goals to their distributed leger counterparts. Identifying the goal of what businesses hope to achieve using blockchain technology can be a challenging approach, because like the internet in the 1990’s, businesses did not yet know how to conceptualize use of the powerful tool. Similarly today, it is known that blockchain technology is capable of instantiating various functions, though how to architect those functions into a business solution requires further insights and assessments of the underlying capabilities.

The three main axes explored — processing and coordination of data, trusted and immutable records, and digitization of assets — are broad enough to encapsulate the primary usability of a blockchain while allowing for further extrapolation of those functions into business scenarios. By discussing these three aspects, it is possible to reveal the meaning behind why a business entity would want to use the technology.

Efficient processing and coordination of information

If improved distributed system design or database coordination is the sole purpose of a protocol or platform, then perhaps a blockchain is not necessarily what is needed. Blockchain platforms have traditionally promoted the concepts of better data coordination and distributed consensus mechanisms in which data is facilitated and transferred through a technology platform. While useful, a significant portion of these desired functional traits can be obtained through better coordination of a central database or improved distributed systems design. In this investigation, it is necessary to determine the extent to which platforms and protocols are trying to optimize existing data coordination functionality versus implementing new blockchain functionality. Blockchains are designed for more than just advanced data coordination.

Immutable/trusted record of the products and transactions

The original thesis around why we need blockchains revolved around the concept of digitizing trust. A theme promoted by Andrew Keys of ConsenSys is that “As the internet resulted in a digitization of information, blockchains result in the digitization of trust and agreements.” This meaningful thesis embodies the ethos of what blockchains hope to achieve while also paving the way for a further path. The additional variable would be the digitization of value. When value is attached to the trust that is implemented into a system, then certain alignment structures and incentive mechanisms will influence and incentivize proper behaviors within a system, resulting in a robust platform.

It is often the case that immutability is used synonymously with trust when designing a system ie because the system is immutable, it is trusted that bad things will not go unpunished. Though in our platform protocol assessment, it is important to also assess the mechanisms behind how a trusted system is implemented to ensure a business model that can be beneficial to users of a platform (further exploration through cryptoeconomics).

Digitalization of assets

The digitization of goods and assets is considered a primary goal for most blockchain or distributed ledger platforms. If businesses are looking for a digitization of assets, a distributed ledger or coordination of a database is able to offer some capabilities though much consideration should be put into the accessibility of these digital goods. Because coordinated databases are essentially centrally run or distributed among a group or subgroups of counterparties via a legacy software paradigm, the levels of digitization may be limited based on the freedom that is afford by the digitizing platform. While the concept of digitizing goods sounds like a simple process, the different incentivisation dynamics and economic reasonings around how goods such as real estate, human attention or even electricity are digitized requires significant consideration into what type of platform would be responsible for the digitization as certain vendor platforms do exhibit degrees of “vendor lock-in” and reliance on a centrally managed platform in various instances.

Records and registries like titling systems and supply chains are also feasible via a distributed ledger system though their level of interaction with an economic incentive layer is fairly limited if reliant on a closed proprietary system, and a proliferation of those assets into a digital ecosystem or marketplace would be severely stunted if based on closed rails. A free market system that fully utilizes the various facets that the open market is able to provide is necessary to facilitate true digital goods in a constantly developing digital ecosystem.

Source/More: Blockchain vs. Distributed Ledger Technologies – ConsenSys Media