For the blockchain market, comparisons to the Internet abound, especially on whether the dot Com crash of 2000 will bear similarities to its blockchain cousin.

A simple analogy would lead you to believe that since we are probably around the 1997-1998 time-frame in relation to Web chronology, when we cross into 2000, a similar crash might happen. For that class of believers, they would have you sit out the current blockchain activity, wait for an imminent blockchain crash, and then pick up its pieces, just as you might have done with the Internet, post 2002 when the post dot-com bear market ended. But that argument doesn’t necessarily hold a lot of water in the blockchain space because of the thesis of this post:

Rather than one big crash that resets the entire field, there will likely be a succession of mini crashes, one following the other. Each one of these mini crashes will flush some bad coins, while simultaneously bringing new ones, and giving birth to new projects of increasingly higher quality.

So, if you are waiting for a big blockchain crash, it may never happen as such, because it is already happening in smaller (yet significant), successive doses. It’s like death by a thousand cuts. More importantly, if you are a venture investor, skipping this period would have you miss the opportunities that continue to emerge, as well as miss the learning experiences which only come from being directly involved in something. Furthermore, while the Internet crash of 2000 put a temporary chill on the funding of new tech companies, the blockchain’s market cap volatility is barely affecting the pace of startup innovation and open sourced decentralization projects that are getting funded.

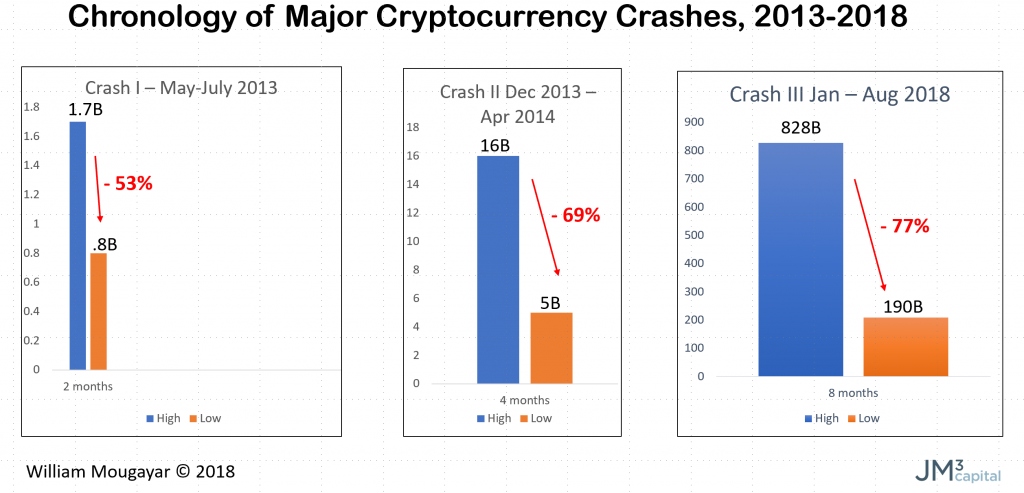

If you look at the recent market highs of January 2018 (and December for Bitcoin specifically), and compare to where we are today, you will see that we already have seen the equivalent of a crash in terms of market capitalization losses, across the board. The low of $190B on Aug 14th 2018 is about one quarter of the market value high of $828B that was attained in January. Many coins are currently trading at 10-20% of their highest value. And there were other crashes prior, when market caps lost billions again. Here’s a chronology:

It is interesting to note that while the first crash took place over a 2-month period, the second one took 4 months to materialize, and the current one has been 8 months in the making. Maybe there is a correlation somewhere, but it may be too early to declare a pattern. Each one of these mini-crashes corrected the market by 57% to 77% of its original value.

In contrast, the dot-com doldrums lasted 19 months to be exact, from March 2000 until October 2002, when several companies lost 80-90% of their stock value, and many didn’t even survive. Interestingly, upcoming companies such as eBay and Amazon also saw their value drop significantly then, but recovered quickly thereafter. The dot-com crash did wipe $1.7 trillion in total market capitalization value for companies, but this is not a fair comparison because that included drops from large, established tech companies such as Cisco and Qualcomm, and not just the dot-com newcomers.

Source/More: Startup Management » The Long (Blockchain) Crash