Bitcoin is a sleeping giant.

This feels weird to write because of how much coverage there has been of the nascent asset, but hear me out. There are two components to Bitcoin — (1) the digital asset that can be held by investors and (2) the transaction settlement network that is run by miners.

Almost all of the press coverage to date has been focused on the digital asset, with very little attention being paid to the transaction settlement network. The network has quietly grown into one of the most interesting stories across technology and finance though.

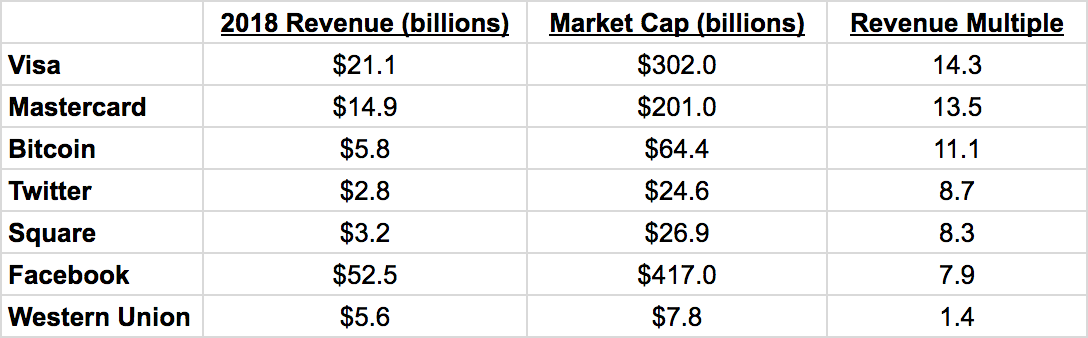

Traditional networks, such as Facebook, Twitter, Visa and Mastercard, are run by centralized companies that capture revenues on a single set of financials. By looking at the financial performance of the centralized entity, investors can quickly evaluate the health of the business, while assigning a revenue multiple to arrive at a valuation.

In the decentralized world, there are thousands (or millions) of separate people/entities that coordinate resources in a unique way to run a network. For example, just like Visa and Mastercard are running a transaction settlement network, thousands of Bitcoin miners around the world are working together to run a transaction settlement network too.

The revenue and financial performance of each miner is captured by thousands of different sets of financials, which makes it incredibly hard to evaluate or arrive at valuations.Diar, a cryptocurrency research firm, has published new data that shows Bitcoin miners were paid a total of $5.8 billion in revenue in 2018 for running the Bitcoin transaction network.

While it it would be difficult to get the full P&L statements for so many different mining operations, we are still able to take this top line revenue figure and put it into context.

Source/More: Bitcoin’s revenue multiple