Casey Research founder Doug Casey explains how he learned to love Bitcoin… Why it’s a wonderful thing… Its potential as a speculation… And how this time, he’s going to make the Bitcoin trend “his friend”…

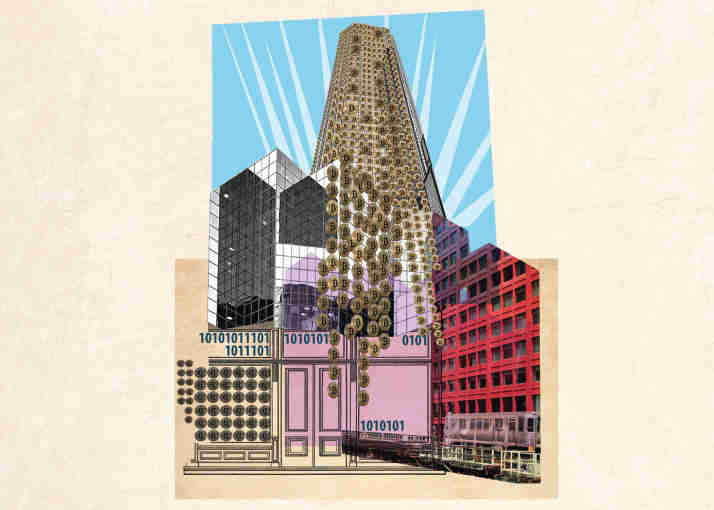

In this article, I’d like to explain how I learned to love Bitcoin. Why it’s a wonderful thing. Its potential as a speculation. How the government is going to co-opt it. And how this is all likely to end.

I was first introduced to Bitcoin several years ago in Cafayate, Argentina. A young Belgian guy came to visit, I bought him lunch, and we discussed Bitcoin. He was a very early enthusiast, and he gave me a physical Bitcoin as a souvenir. They’re now collectibles, but the digital codes are inscribed on them. I still have that Bitcoin. It was worth $13 at the time.

I wish I had listened to his argument more carefully, because I could have made millions. Over 600-1 in just a few years… that’s rare indeed. I was inclined towards it philosophically, but outsmarted myself on an investment level. Because Bitcoin was pitched to me as an alternative currency, and I failed to see all of its advantages in that role.

My original objection was that Bitcoin isn’t backed by anything. It’s really a private fiat currency. It’s very much like the Zambian Kwacha, the Argentine peso, the US dollar, or any of the other 150-plus currencies in today’s world. It’s a floating abstraction. Unlike state currencies, though, its acceptance isn’t enforced by laws. But, on the other hand, its quantity is limited. Would that be enough to get large amounts of people to use it as a currency?

I missed something when I said, back then, that it had no value. It’s a fiat currency, yes, but it has much more practical value than any other.

A currency has to be a good medium of exchange, and a store of value. I’ll have more to say about this in a few paragraphs, but Bitcoin’s big fault is that it’s so volatile. In other words, it’s nice to see your savings perhaps double in value over a few weeks. But few want to risk them losing value the way Bitcoin did in the recent crypto winter, when it went from about $20,000 to about $3,000 in 15 months. That said, as more people adopt Bitcoin, it should stabilize. But Bitcoin has already gone from being a wild speculation to a useful monetary tool. I believe it will keep improving, rapidly.

Why? Analyze the situation rationally, using Aristotle’s five characteristics of a good money. Aristotle defined the five characteristics of good money in the 4th century BC. His analysis is as accurate now as it was then.

A good money must be durable, divisible, convenient, consistent, and have use value in and of itself. Based on that, Aristotle believed gold and silver were best suited for use as money. How does Bitcoin compare using these five criteria?

Durable. Bitcoin and other cryptocurrencies are definitely durable – unless we have a major electromagnetic pulse (EMP) or a significant solar flare that wipes out all the computers. Bitcoins are not as durable as the metals, but they’re adequate, barring a veritable collapse of civilization.

Divisible. Bitcoin is infinitely divisible. Better than the physical metals, actually – although the metals can be accounted in tiny fractions too.

Convenient. Yes – as long as you have a smartphone, Bitcoin is very convenient. But your smartphone, or something like it, may not always be with you. And your counterparty also has to have one. And it’s not very convenient if someone doesn’t know or trust Bitcoin. Right now, that’s still probably 98% of humanity.

Consistent. Absolutely. Every Bitcoin is exactly like another one. It’s at least as good as .999 fine gold that way.

The problem I had with Bitcoin was the fifth point: Does it have use value in itself, so you can’t get stuck holding the bag?

If you have a million US paper dollars, and nobody accepts them, they have no use in and of themselves – except as wall decorations or kindling. They’re just unsecured liabilities of a bankrupt government. In essence no better than a million Zimbabwe dollars, although there’s obviously a continuum. Fiat currencies can be easily destroyed by their issuers. The things are burning matches. They have half-lives, like radioactive elements.

Sure, there were advantages to Bitcoin being a privately issued fiat currency. But I didn’t see its real use value; that’s where I went wrong.

Bitcoin is certainly a fiat currency like the dollar or the Kwacha. But it’s also an excellent transfer device. You can move wealth from one country to another, or to another person, quickly and privately. I’d say secretly, but you’re not supposed to say “secret” anymore, you can only say “private.” Part of the politically correct corruption of language, I might add.

Better yet, you can do so outside of the banking system, which is increasingly important. If you use Bitcoin, you don’t need a bank to store your money.

Cryptocurrencies, like Bitcoins, are just the first, and most obvious, application of blockchain technology. Hopefully, among other things, blockchain and Bitcoin are going to destroy the SWIFT system, the vehicle for wiring money from one bank to another. SWIFT is expensive (typically $50-100 per transaction), slow (generally a day or two, sometimes a week or more), and insecure (who trusts either big banks or the US Government?). And SWIFT requires that all dollars clear through New York; non-Americans don’t care for that. SWIFT is used by thousands of banks around the world to send payment instructions worth trillions of dollars each day.

So, this is one big use value of Bitcoin. It allows you to transfer something that is accepted as money outside of the banking system, privately, and outside of government fiat currencies.

Bitcoin is well on the way to being accepted as money. I think it will succeed. Remember, money is just a medium of exchange and a store of value. Almost anything can be used as money. Some things are just much better than others.

Source/More: Doug Casey on Bitcoin, Part I – Casey Research