Initial Coin offerings are very 2017. New evidence suggests one in 2 ICOs failed in the 2nd quarter of 2018— and those that succeeded suffered huge losses. However, all is not what it seems.

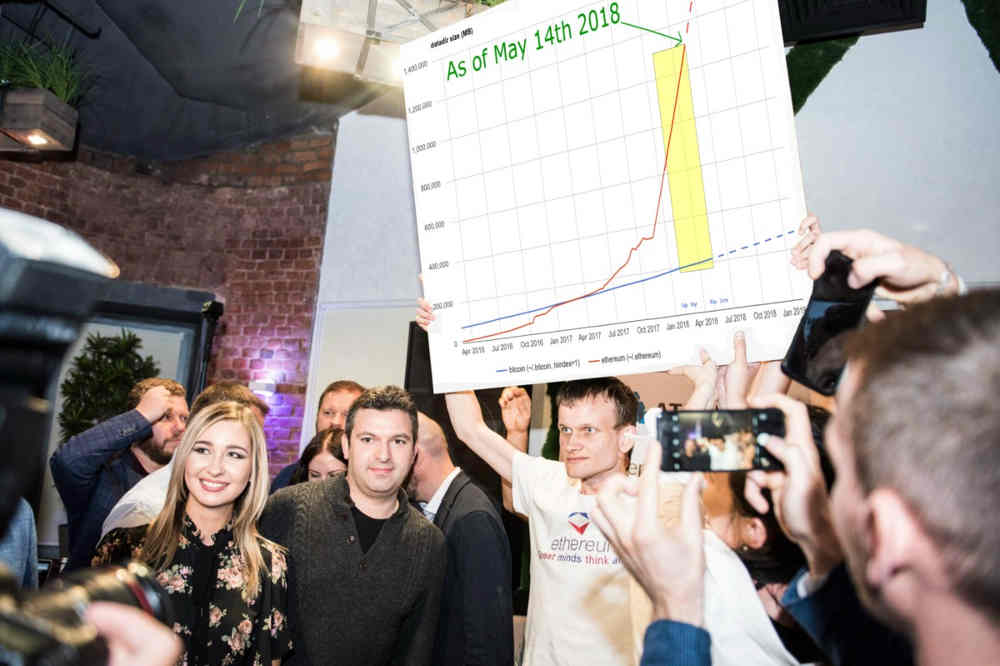

The failure rate of ICOs appears to be increasing, at least according to data of Q2 2018.

- 55% (Fifty-five percent) of so-called initial coin offerings failed to complete in the second quarter, according to a report from the agency ICORating.

Most analysts take this to mean that the quality of projects in the market had “significantly worsened.” However it’s likely a bit more complicated. Regulatory pressure from the SEC and ICO Bans for digital platforms also dampened the mood. Not to mention Bitcoin’s price vortex.

More worrying is that compared to Q1, the average return for ICO tokens in the quarter was -55%, compared with a gain of nearly 50% in the first quarter.

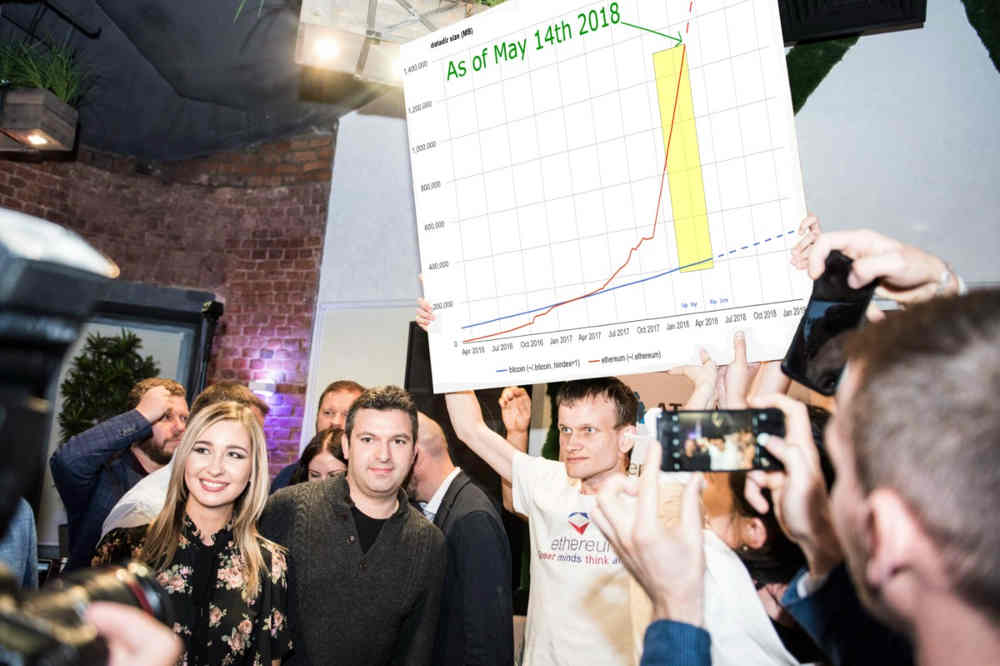

ICOs are a fundraising method in which companies and projects issue digital tokens structured like Bitcoin or Ethereum.

Outside of huge amounts raised by the likes of Telegram and EOS in recent times, there’s increased data on coin death, the tendency of low-quality altcoins to die fast. It brings new meaning to the term “fail fast”, as the fraud, hack and phishing rate remains high for unvetted ICO and crypto projects.

While ICOs exploded from almost nothing to be a multi billion-dollar market in 2017, however in 2018 they appear even more speculative, risky and dangerous to the layperson investor.

The recent report by Autonomous Next sheds light on this here (Mania), and here (Utopia). Not entirely surprisingly therefore that as competition increases, so does the failure rate.

The increasing failure rate came despite a rise in the amount of money being invested into ICO tokens. The report said 827 projects raised $8.3 billion through initial coin offerings in the second quarter of the year, compared with $3.3 billion in the first quarter, according to Business Insider’s coverage on the issue.

If fewer projects are attracting bigger sums, while many others languish with small sums or outright failure, it spells a movement towards bigger players that we are seeing in the larger space; where private instead of public blockchains might be more the order of the day as bigger players enter the space: e.g. Bakkt. Bakkt’s focus on digital assets was wildly acclaimed by crypto insiders and the media as being potentially disruptive.

Source/More: The Failure Rate of ICOs is Skyrocketing in 2018 – FutureSin – Medium