Block by Block is a series where we dive into different industries and examine the entry-points for decentralization.

Insurance is a multi-trillion dollar industry plagued by opacity, misaligned incentives, and fraud. Insurance is supposed to help with the cost and stress of damaging unforeseen events. Yet, when an unforeseen event occurs, policyholders often end up having to fight to prove the legitimacy of their insurance claims to companies whose profits are impacted by the number, and the dollar amount, of payouts. By bringing transparency to an opaque industry and democratizing data for policyholders, blockchain-enabled insurance platforms aim to fix the deficiencies that shroud traditional insurance companies.

Where are the points of entry for decentralized insurance platforms?

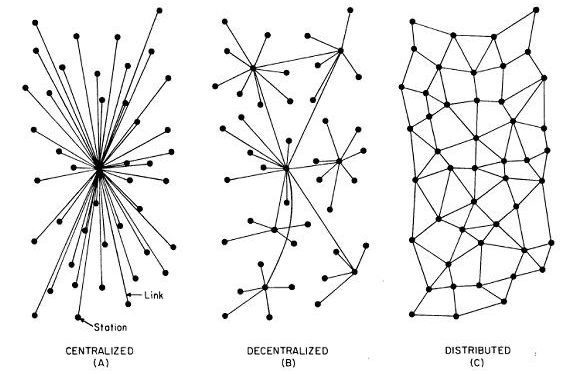

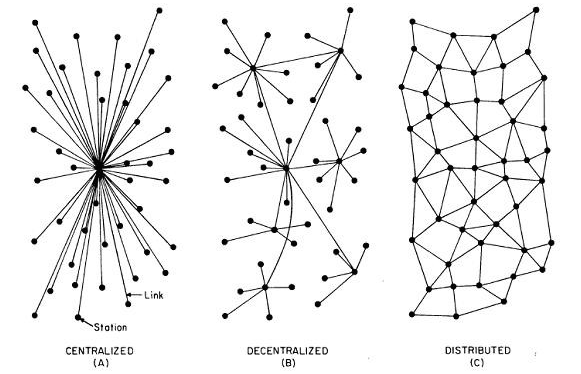

- Opacity: Insurance is an opaque industry. There are multiple studies that examine inadequate transparency of the insurance industry. From limited disclosure to an overall lack of consumer protection laws, the insurance industry often finds itself in the midst of a grey legal area. As an example, in 2016, the Illinois State Treasurer sued three insurance companies in order to audit their records and identify death benefits that should have been paid to families of the deceased policyholders. The State Treasurer found that between 2011 and 2015, there was an estimated $550 million in unclaimed life insurance benefits. The opaque and complex process of an insurance claims process, underpinned by the lack of incentives for insurance companies to help clients make claims, are detrimental to policyholders and favorable for insurers.

- Data Collection: In the traditional insurance industry, a policyholder’s data is collected for an insurance application and permanently kept by an insurance company/broker — even after an insurance policy has expired. Brokers are the dominant distributors of insurance products on behalf of insurance companies. According to The Block’s research, virtually all of an insurance company’s commercial lines come through brokers. These brokers dominate the industry and greatly benefit from its opacity. In 2017, the top three brokers generated about 40% of the revenue among the top 50 brokers in the U.S. The billions of dollars in revenue generated by these brokers enable them to collect data and information in huge private silos — leveraging this information to outcompete their smaller competitors.

- Fraud: Over $40 billion annually is lost due to insurance fraud — and this does not even include the health insurance industry. One of the most common types of fraud are double billings. Double billing is when a practitioner submits a bill to an insurance company multiple times for a procedure that only happens once.

Source/More: Block by Block: Insurance – The Block