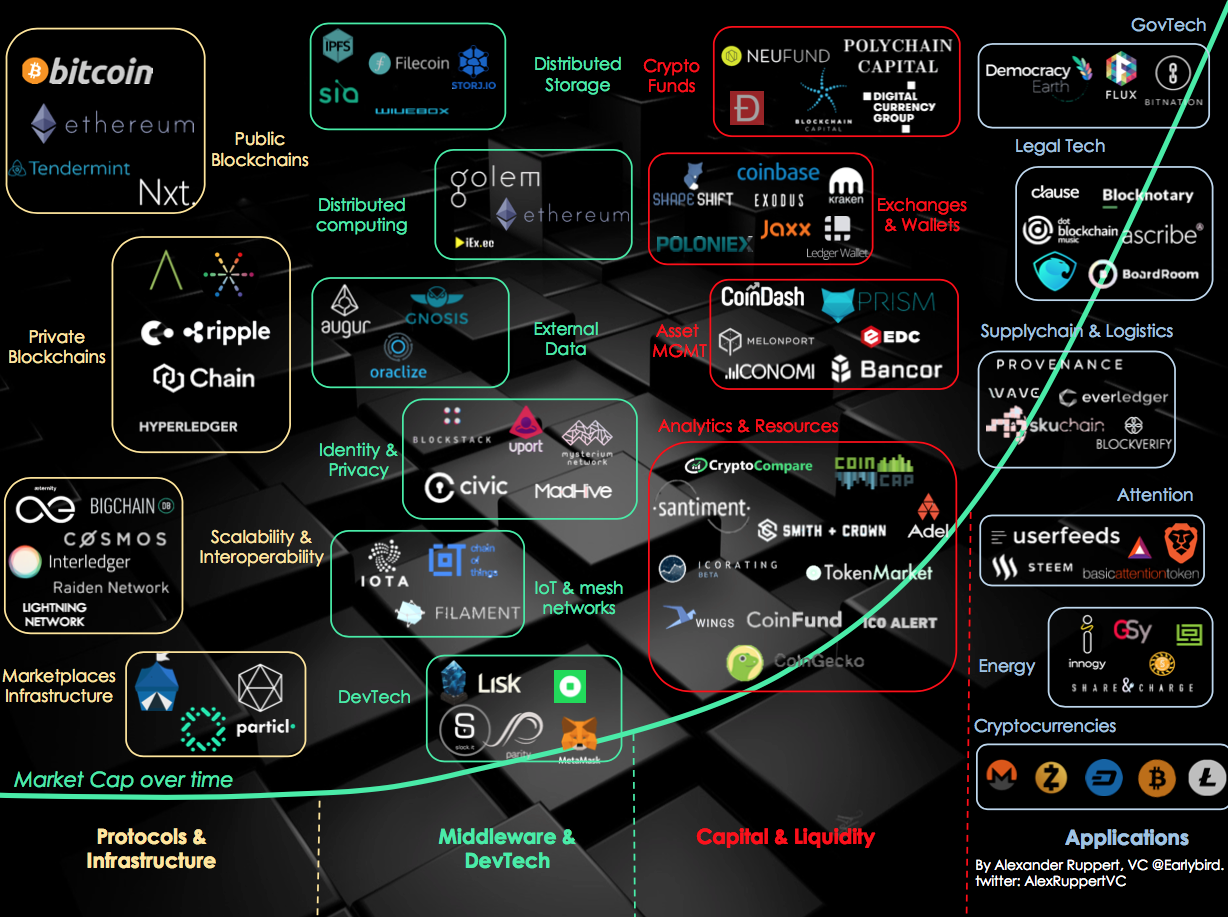

Mapping the decentralized world of tomorrow

The Media is going crazy about Bitcoin, Ethereum and the rise of crypto markets. Entrepreneurs from the sector have kind of a Rockstar status raising millions of USD in seconds through ICOs. However, the crypto sector is much more than Bitcoin, fintech, trading and crypto currencies — it’s about building a better, decentralized, (digital) world.By using the term “decentralization” I refer to a process of redistributing functions, people, powers or things away from a central authority. The problem with centralized systems is that they lack transparency, allow for single points of failure, censorship, abuse of power and inefficiencies. The fundament of their existence often is missing trust within communities or networks, so they need a trust building intermediary to be organized. Paradigm shifts towards decentralized systems are enabled by new technological breakthroughs (i.e. blockchain, cryptography, consensus mechanisms), a rapidly growing developer community as well as new ways of raising capital.

General

- The waves of innovation flow from “left to right” — starting with platforms and protocols followed by middleware, new financing methods and finally decentralized applications built on top of all that. The total market cap follows this path.

- As of today most of the value in terms of market cap is created on the protocol layer (“fat protocols”) — about 70% of the market cap relate to Bitcoin and Ethereum ($51 bn of $71bn on May 29th 2017). One could also classify Bitcoin as an application though but it’s share of total market cap will significantly decrease over time. The more applications are built on top of the underlying systems and the more users become part of the networks, the more the underlying token gains in value.

- Value is created on token level rather than on equity level, therefore opposing everything we experienced in conventional software businesses. Tokens represent an atomic unit of a company’s business model. Some are sold to finance the project but their main purpose is to monetize products and services in the long run. Tokens don’t make sense for any business model and need to fit into the company’s landscape of services to be useful.

- Due to the strong influence of speculators and traders most parts of a crypto token’s value are based on speculation. A more objective approach of valuing a token would be to define its “utility value” by analyzing real life KPIs such as the activity of developer communities surrounding the project (github repos, contributors, quality of code), number of nodes and miners running the network, number of network transactions etc. over time.

- Before launching end user facing, decentralized applications (Dapps), the underlying infrastructure needs to mature. Even on protocol layer we are still facing challenges around transaction costs and overall scalability of bitcoin or consensus mechanisms of Ethereum.

Source/More: Mapping the decentralized world of tomorrow – Earlybird’s view – Medium