Bitcoin has become one of the most controversial financial instruments across the globe. Based on a shared public ledger named after a blockchain, the bitcoin has rapidly become known to the average retail trader and has been a rising star among speculators.

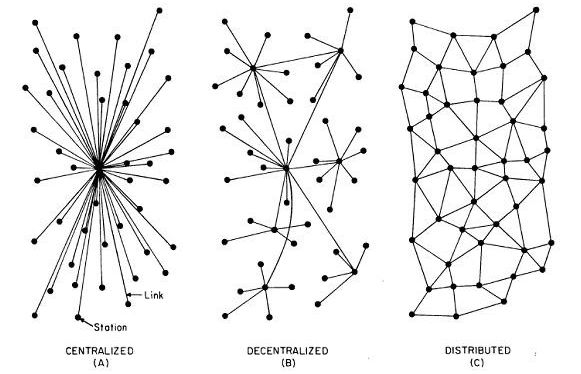

In practice, the bitcoin market is meant to be perfectly decentralized. In addition, all bitcoin transactions are included on a blockchain and the set of rules by which the memory of transactions move is determined by the miners themselves. If some miners would like to change the rules, they need to fork it.

Lately, a group of miners decided to apply different rules to validate a transaction. It gave birth to two different cryptocurrencies; Bitcoin Cash and Bitcoin Gold. Both immerged as a solution to a different problem. Bitcoin Cash was created in August 2017 and was designed to increase the bitcoin’s capacity crunch by larger blocks, allowing more transactions to be processed. Bitcoin Gold saw the daylight in October 2017 to re-decentralize the mining industry that has become too centralized due to efficiency reasons.

The original bitcoin was exchanged at $7’882 per unit on November 8, more than six times the price of an ounce of gold on the same day. Bitcoin erased more than $1’000 on news that a new upgrade to the blockchain known as SegWit2x has been dropped due to lacking support. The sell-off erased nearly a third of the bitcoin’s market value, but hinted that the progress in cryptocurrency technology will likely develop further.

The question is, how long could the original bitcoin defend its value provided that a democratic system would naturally cause more forks to immerge and disperse value.

Source/More: Bitcoin, a new asset class