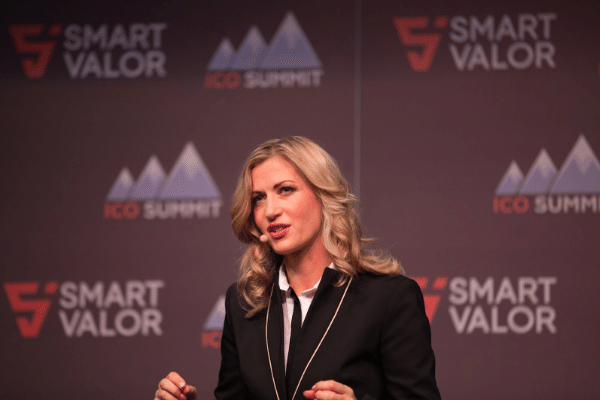

Bitcoin veteran Olga Feldmeier is creating new types of tokenized investments.

Back in 2013, when bitcoin prices ranged from $600 to $1,000 instead of hovering around $10,000 as they did last Monday, Olga Feldmeier spent her days working at the UBS bank of Switzerland. By night, she explored new blockchain technologies and thought about the economic travesty inflation once wreaked in her Ukrainian hometown. “I’ve seen what it means to be poor,” Feldmeier told International Business Times. “Security used to be a privilege of the rich. Today anyone can buy bitcoin.”

Feldmeier went from UBS to the the bitcoin wallet provider Xapo and helped establish the Crypto Valley Initiative. “My role was to coordinate the regulatory aspect, to apply for licenses,” she said. “We had this chance in Switzerland to shape the regulatory space.”

Xapo was one of the first bitcoin companies to get official approval to operate in Switzerland as a financial intermediary while being relieved from applying for a banking license. Switzerland is now known for its small and nimble government infrastructure, a great fit for the rapid evolution of blockchain technologies. CoinDesk reported Swiss blockchain industry meetups have more than 2,000 members.

“It made sense to create a new regulatory case for bitcoin…helping regulation to evolve,” Feldmeier said. “You can engage in conversation about how should we regulate this. It’s a much more inclusive process…That is what is unique about Switzerland, which you don’t have in the U.S.” While CME Group Inc. is still seeking regulatory approval to try create lawful blockchain-based futures, to help manage volatility and hedge bitcoin positions, Reuters reported the Swiss bank Vontobel already started trading Switzerland’s first bitcoin futures.

Source/More: Meet The Bitcoin Queen Of Switzerland’s Crypto Valley