African millenials explain to Catherine Byaruhanga the attraction of risky cryptocurrency Bitcoin.

Bitcoin’s eye-watering price surge over the past year is proving too tempting to resist despite fears that cryptocurrencies are a bubble floating towards an inevtitable burst. One group for whom it holds particular appeal is African millenials, writes the BBC’s Catherine Byaruhanga.

Thirty year-old Peace Akware in Kampala is a convert to the crytocurrency craze. Like any self-respecting middle class millennial here her smartphone is always within reach and with it her digital wallet.

“I check my Bitcoin every day and any chance I can get. Any minute, any hour, anytime, as often as I can,” she tells me from the small bungalow she rents on the outskirts of Kampala.

Finding a job here is almost like a lottery for graduates so Ugandans often have so-called side hustles. Peace has sold clothes and even got into money lending. Both failed. But buying cryptocurrencies like Bitcoin appeals to her because it requires less of her time and there are no upfront costs.

She’s bought more than a thousand dollars worth of bitcoin. So far the gamble is paying off and overall she’s seeing her digital value rise. “You know there’s potential for it growing even further. I would like to buy a car. I would like to buy land. I would like to build with it”.

Disrupting remittances

It’s not just those hoping to get rich quick who are getting in on the action.

In parts of the continent – especially commercial hubs like Lagos, Nairobi and Johannesburg – a small but growing number of people are finding that cryptocurrencies offer a cheaper solution to an expensive problem – transferring funds across borders.

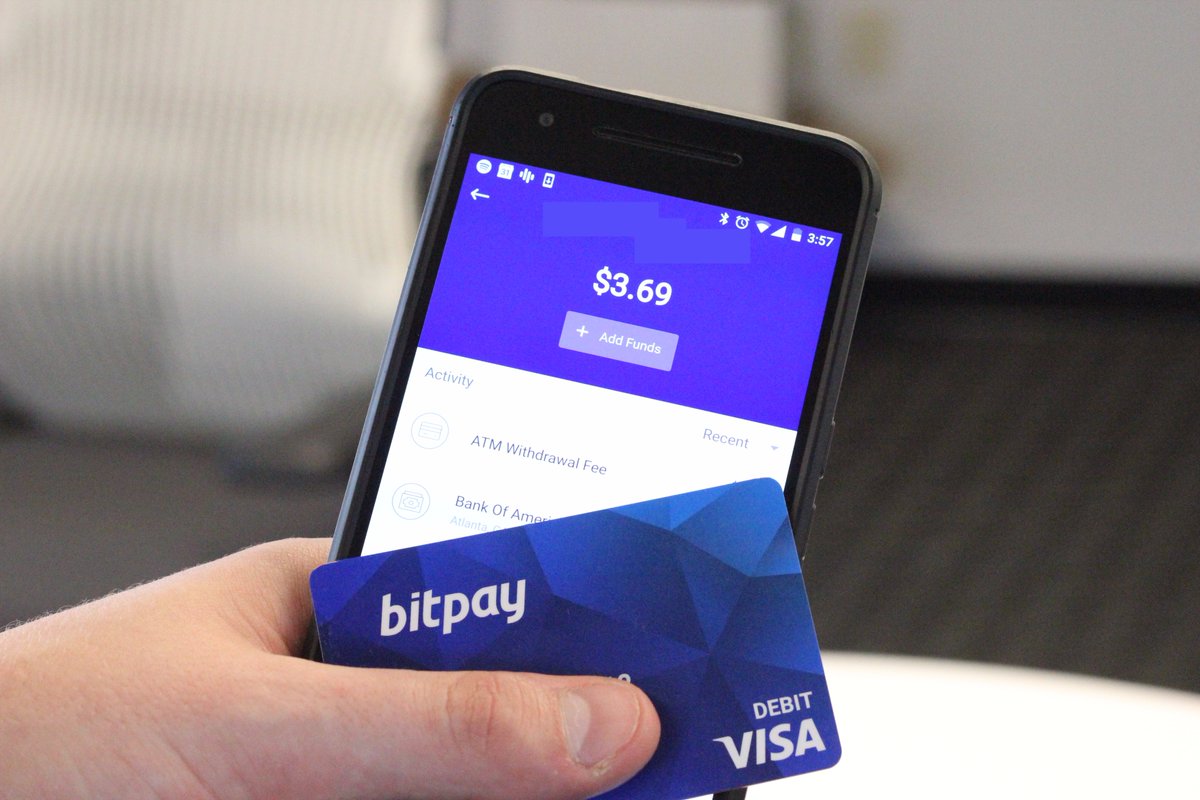

The technology platform Bitpesa uses Bitcoin as a medium to transfer cash across borders.

It’s like a remittance company.

With traditional remittance companies like Western Union, when you transfer money initially it goes from your local currency into dollars then on the other side they receive dollars which are then converted into the local currency.

You lose a lot of money in that conversion.

What Bitpesa does is substitute the dollars with bitcoin. It’s cheaper, especially when there is a shortage of dollars in the country or restrictions on accessing dollars. It’s also quicker because you don’t have to go through long complicated bank approvals.

Elizabeth Rossiello is the CEO of Bitpesa. Even as someone who knows how the finance world works, she gets frustrated with traditional banking.

Source/More: Why African millennials can’t get enough of Bitcoin – BBC News