A ‘MythBusters’ fan? You’ll love this…

Cryptocurrencies have been in the market for a decade now, and its introduction saw them join the ranks of fiat currencies as a viable mean of payment. However, even with all the benefits that crypto offer today against traditional currencies, not many are enthusiastic about them. Why? While there is not a single answer to this question, one of the reasons might be the wrong beliefs around cryptocurrencies and their underlying technology, blockchain.

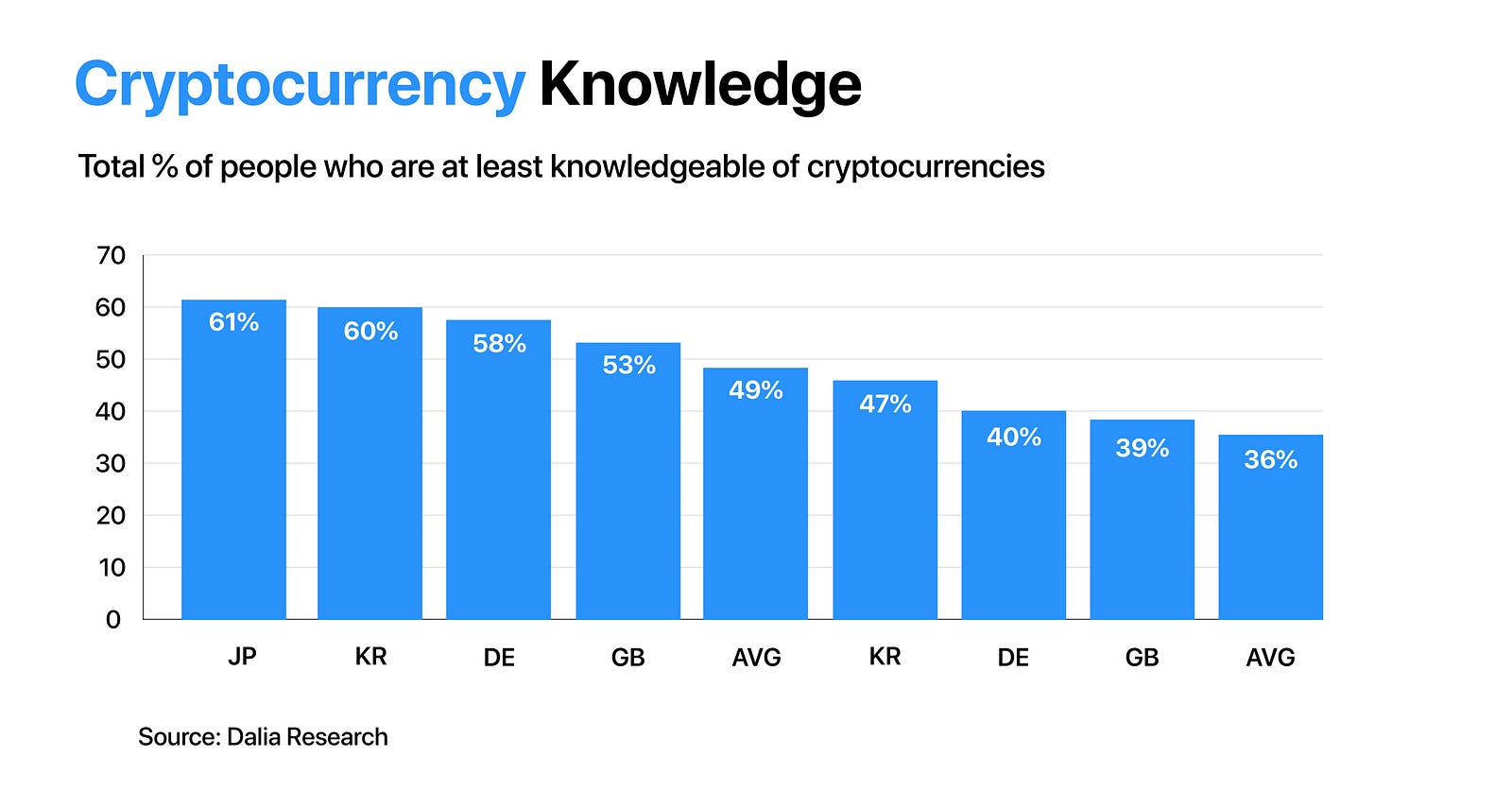

A recent study shows that more than 60 of internet users are currently familiar with cryptocurrencies. Since familiarity breeds contempt, a lot of ‘familiarities’ and not enough information has bred some misconceptions about cryptocurrency.

For that reason, we’ve taken the time to debunked the most common myths and misconceptions about Bitcoin and other cryptocurrencies. Ready? Let’s get to it!

Crypto is a Replacement of FIAT Currencies

There was a time when TV was thought to kill radio; the US dollar was once anticipated to replace gold. And now cryptocurrencies are said to be a replacement for fiat money. Don’t get us the wrong way. We are all-in for this to happen, but the truth is that fiat currencies are not going anywhere anytime soon.

Nowadays, paying with cryptocurrencies is a truly seamless experience. You can either load them to a prepaid crypto card like the Crypterium Card or cash out directly to a regular bank card using an instant payouts service.

However, many people around the world continue to rely on traditional paper money. Brazil is a good example of strong cash dependency. Only last year, Brazil’s Central Bank published a report that reveals nearly half of the country’s workforce continues to get paid in cash. And that isn’t all. An additional research by the Brazilian Service to Support Micro and Small Enterprises outlined that 60% of local businesses doesn’t have POS terminals to enable card payments.

Bitcoin is Anonymous

Bitcoin is often described as ‘anonymous’ as it’s possible to move funds without providing any personal information. But that’s not entirely true. In fact, you should think of Bitcoin as ‘pseudonymous’ instead. Each transaction is registered on the blockchain under a wallet address. If that address is ever linked to your real identity, then you’re exposed!

Moreover, there are sophisticated instruments that are used by government and financial entities to track identities and that provide blockchain forensics for illegal activities.

Monero and Dash, for example, are regarded as the best privacy coins for offering higher ‘anonymity’ to their holders. In the case of Monero, transactions are divided into randomized amounts and mixed between stealth address, making it impossible to track the real origin.

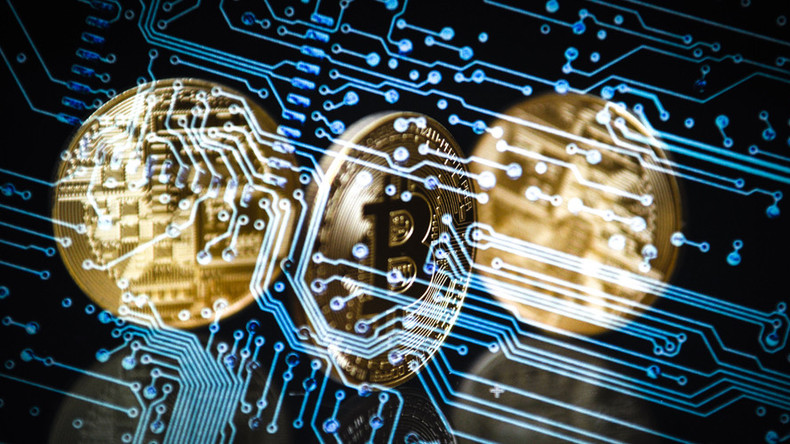

Cryptocurrencies have no “Intrinsic Value”

“The idea that [Bitcoin] has some huge intrinsic value is just a joke in my view,” said Warren Buffett, one of the world’s most influential investors. And guess what? He is right.

Now, do you think FIAT currencies have “intrinsic value”? Almost nothing in the world of trading and money has it. The value of FIAT money, issued by nations, largely depends on the support fixed by governments. Bitcoin, unlike the dollar or the euro, has a limited supply, which is certainly a point on its side as it can’t be easily manipulated.

Let’s stop for a moment and see if Bitcoin and crypto actually fit the attributes of money:

Source/More: Myths & Misconceptions About Bitcoin (Finally) Debunked